In 2023, it was clear that the market was continuing to adjust from the frenzied post-pandemic scene in the early 2020s. Inventory of homes listed reached a record low by July of 2023, and mortgage rates increased dramatically, diminishing buyer affordability. Furthermore, potential sellers with covid-era mortgage rates of around 3% weren’t listing because they’d have to give up that historic rate and trade it for one that is likely two times higher or more.

Now in 2024, the inventory of homes has been steadily rising, but mortgage rates have recently dipped, so the real estate landscape is still readjusting itself from the frenzied pandemic market. Many sellers are holding the line, and buyers continue to face competition. The still lower-than-normal inventory levels have prevented prices from falling, so buyers are dealing with rising prices and rates that are lower than the past several months, but which are still elevated compared to a few years ago. The result is buyers are still faced with some of the highest monthly mortgage payments in history.

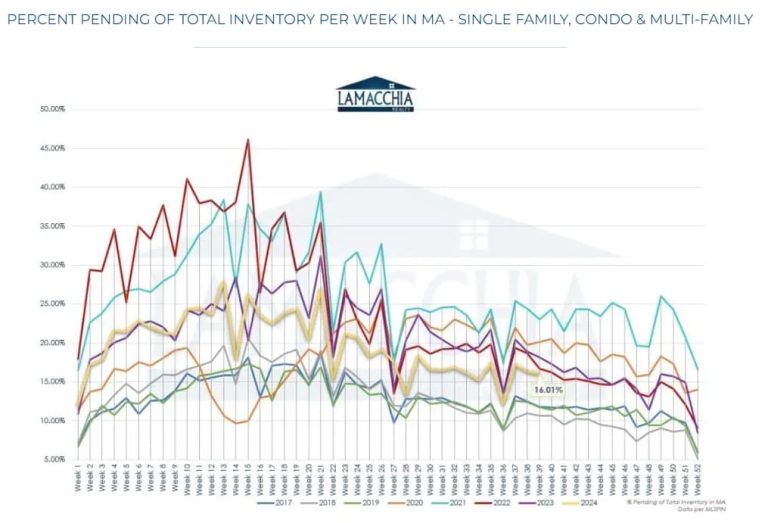

Pending home sales are down when compared to this time last year. This is a result of not only the current market conditions, but consumers are dealing with the challenges of inflation and uncertainty related to global events. Additionally, many are still struggling seeing a rate that is basically double what it was a couple years ago, despite the recent softening.

In the Massachusetts graph below, you can see that 2023 started with a high absorption rate, demonstrated by the purple line. Right around late spring/early summer, the line started to fall beneath the prior year, and it stayed that way. The yellow line represents this year and continues to land beneath the previous two years. With sales down slightly over last year, and inventory up, it is no longer a lack of homes to buy keeping sales down. Affordability is likely becoming the issue. Buyers are hesitating to pull the trigger because of sticker shock and sellers are finding their homes are sitting on the market longer.

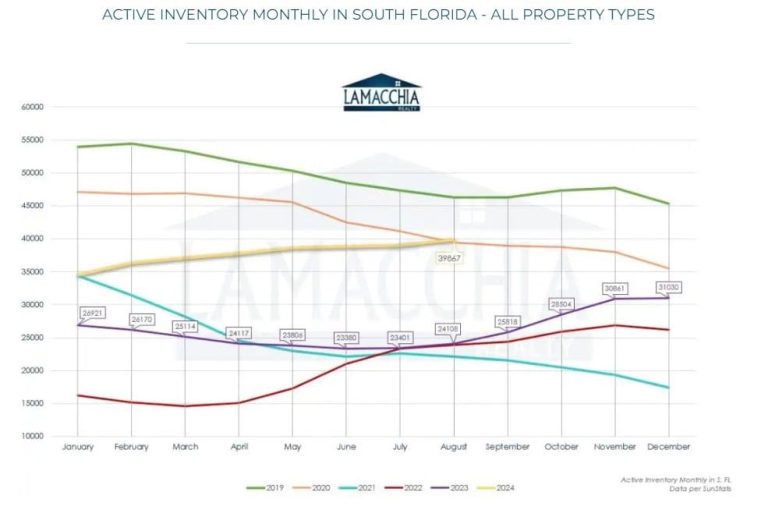

In the graph for South Florida below, you can see that inventory is rising above what it was in the past three years and is about where it was in 2020. The Sunbelt states exhibited a super frenzied market during the work-from-home phase of the pandemic. Inventory was lower than it was in New England which is why the inventory is higher now over the past four years but still low compared to pre-pandemic levels.

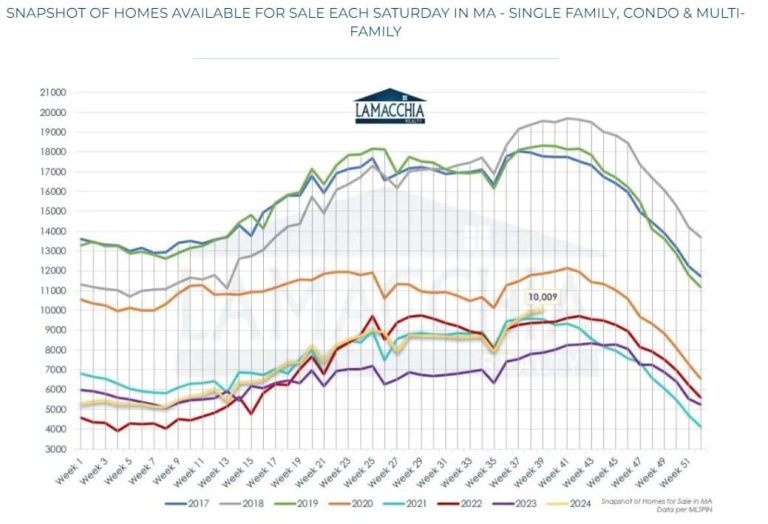

The graph for Massachusetts below indicates the number of homes for sale every Saturday has been lower every year since the pandemic started. Inventory began to rise in mid-2022 and again many assumed that inventory would continue to rise, but with rates skyrocketing, the opposite started to happen, around the same time the absorption rate started rising in late spring/early summer. Since then, the number of homes listed has been lower than in previous years. There is some hope, as the number of homes listed is higher this year than in 2023 and 2022, leading to an increase in available inventory as shown by the yellow line.

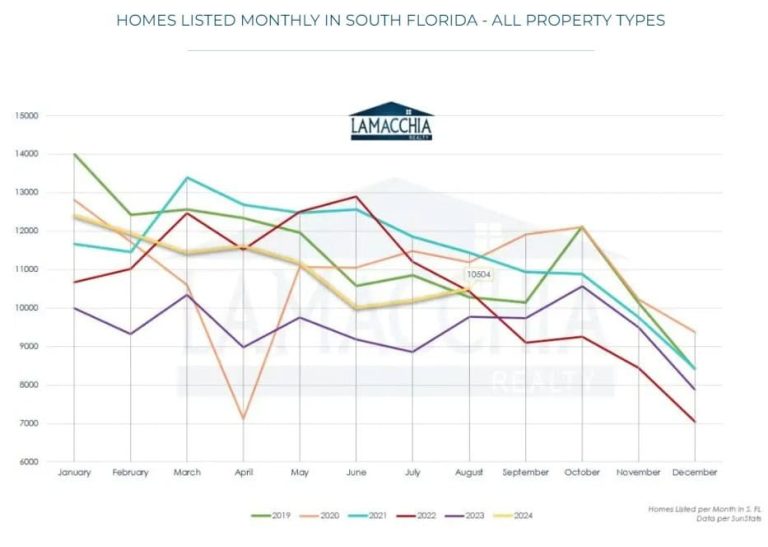

South Florida in 2023 exhibited the lowest number of homes listed, with the exception of the start of the stay-in-place mandates in April 2020, but started rising over last year in mid-August. In both areas, we are seeing slight increases in the number of homes listed compared to previous months, likely due to seasonality, rates rising, and global uncertainty. But though a rise is a good sign for buyers, the increases haven’t made enough of a leap to satisfy demand.

So, what does all of this mean for price adjustments?

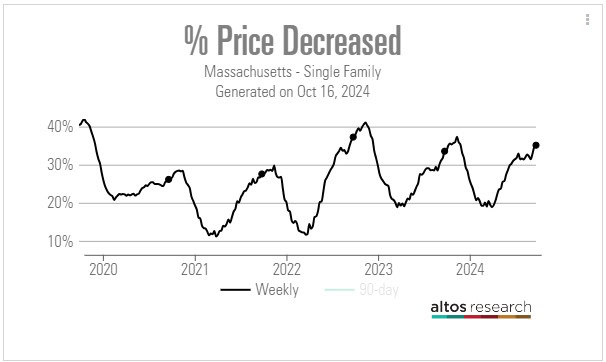

In 2024 price adjustments (or reductions or improvements- there are multiple names for it) are up over last year. In Massachusetts alone, price adjustments for single families, multi-families, and condos year to date are up by 30% over the same time last year. There were 11,453 listings with price changes in 2023 per MLSPIN and 14,901 so far this year.

Source: Altos Research

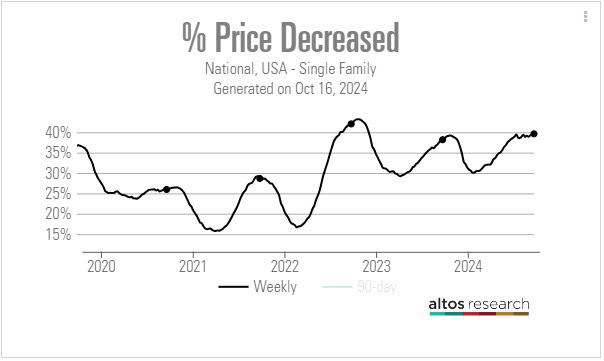

Nationally, the story is similar.

Source: Altos Research

Inventory is rising from the depths of 2022 and 2023, yes. But so has inflation and prices over the same timeframe. When buyers hesitate to make an offer due to the highest-ever expense of ownership, homes sit longer on the market and so the impetus is on the seller to reduce the list price to attract more buyers and create stronger demand.

If a home has been listed and isn’t selling, that means the list price may be too high. Sellers create demand with accurate pricing and aggressive marketing. If their home is on the market with a high list price, it will likely sit, and a price adjustment will be the first step in attracting more buyers.

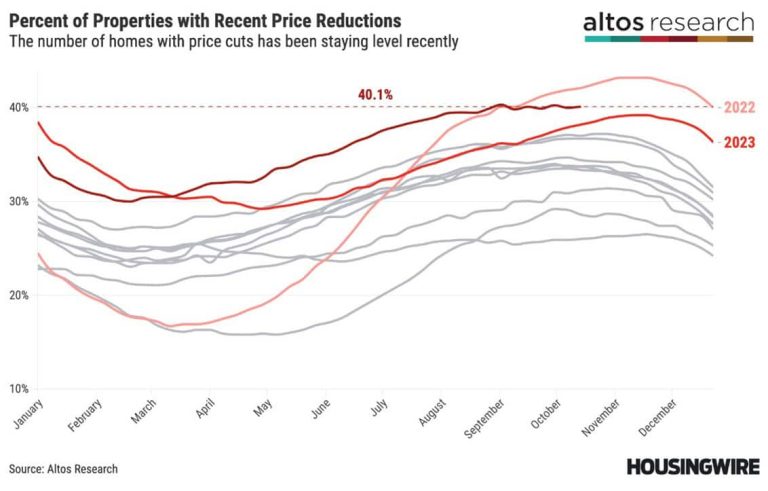

The need for price adjustments over the past few years has wavered significantly due to the tectonic shifts in the market. Price adjustments generally kick off the year in a decline until March, then rise until November and then drop again until a new year begins. 2022 saw an incredible spike going from almost the lowest we have seen in years nationally to the highest by November. 2023 leveled out a bit but at an elevated level, and 2024 has been steadily higher than last year since mid-March. The trend line has flattened since September, and it remains to be seen if that’s going to continue through the rest of the year. A lot has to do with rates and the impending election.

Source: Altos Research

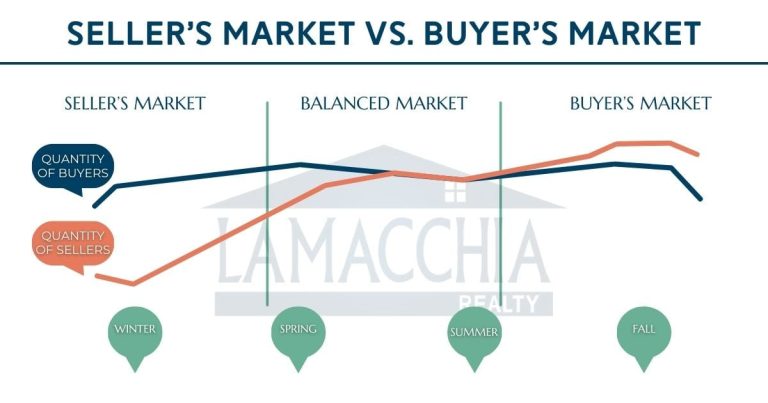

Typically, it would take more inventory than buyers to shift from a seller’s market to a buyer’s market, and this usually happens in the second half of the year. In the graphic below, you can see this more clearly. It’s a sellers’ market at the beginning of the year with lower inventory than the number of buyers, but by fall, the number of buyers drops below the number of sellers, and it therefore becomes a buyers’ market. Sellers then become the ones who need to compete.

This year, we are still in a seller’s market where buyers are the ones who need to compete for homes due to the low inventory, and if they’re priced out in a bidding war, two things happen. First, the losing buyers are still actively pursuing new listings, keeping demand high. Second, the elevated sale prices resulting from bidding wars are preventing prices from dropping.

We have been telling buyers for years now that there is a cost of waiting to buy; prices have continued to rise, and rates couldn’t possibly have stayed at the historic lows we were seeing. So here we are. The same, however, will be true for sellers. There will be a cost of waiting to sell when the tides turn.

Rates are high, buyer affordability is low, and those sellers that need to sell, they need to market their home to buyers by making their home more affordable. The more affordable the home is to more buyers, the more demand is created for the home, and buyers will compete for it resulting in a multiple-offer situation.

Sellers may be concerned about the negative connotations that accompany a price adjustment, but if the home has been available long enough without any offer activity, it’s time to consider adjusting the list price to gain more visibility from more potential buyers.

An experienced REALTOR® will make it very clear from the beginning that pricing right is the key to selling faster and for more money. But even with all the data at hand, determining the exact price isn’t always easy, especially in a shifting market. There are factors such as comparable active properties, time of year, recently sold properties in the area, condition of the property, and current market conditions to take into consideration when pricing a home. Even if the home is priced appropriately, the market could shift quicker than anticipated and a price adjustment may be the next best step. As well, looking at a home in which the offer was accepted in January will not have a comparable list price to a similar home listed now, as the market is much different at this time of year.

How do you know your house is overpriced?

1. Your home is priced much higher than properties in your area

Your REALTOR® will complete a comparative market analysis of the homes sold in your area in the past 2-3 months. This is a common method to determine the target price range for your home. Neighborhood homes are valued relatively close to one another if their size and condition are relatively similar. If you price your home even 5% over the rest, your home may be overlooked. This is a strong sign that a price adjustment is in order.

2. Infrequent showing requests

The first thing that buyers see when they browse homes for sale besides pictures, is the list price. If that price doesn’t reflect the images or the area, they’re not going to bother to come see it. If you don’t have any requests for showings and if an open house yields an underwhelming crowd, you should review your list price and lower it to attract more buyers. Remember, buyers determine what they can afford based on what their monthly payment will be, not the total mortgage, so as a seller it helps to get a sense of what a buyer will have to spend every month to own your home.

3. A few weeks goes by without an offer

Due to the inventory levels in the last couple of winter and spring seasons, many homes sold for over asking in multiple offer situations. If your home has been on the market without any strong offers, it may not be priced correctly. In a typical real estate market, a seller should receive at least one offer within the first two weeks of listing the home. If three weeks go by, contact your REALTOR® to discuss an adjustment to the list price.

4. You hired the agent who recommended the highest price

It’s not necessarily wise to go with the REALTOR® who said to list your home for the highest number. That could be a sign that they’re not fully understanding the market in your area and that they may underdeliver. Make sure you fully grasp why your REALTOR® suggests the price that they do by asking them to show you comps in your area that have sold recently and that are currently active on the market. If their price is outlying the comps, you’re risking the loss of a fast and strong sell price.

When and how much should you adjust the price?

If you’re questioning whether it’s time to adjust, then it’s probably time to adjust. If enough time goes by without a strong offer or a decent response to the listing, adjust the price. There’s no sense in delaying the inevitable and the sooner that you attract more buyers, the sooner you’re likely to receive requests for showings and offers.

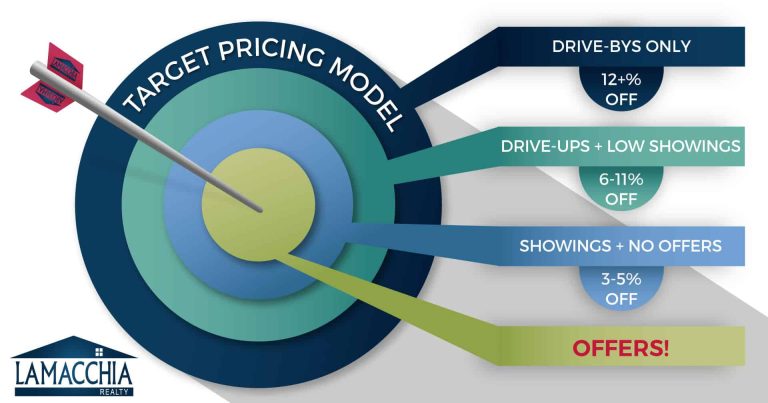

Lamacchia Realty has been selling homes since 2005 and tracking data to develop an effective model for pricing homes. The Lamacchia Realty Target Pricing Model has been implemented in the selling process since 2007.

Despite an earnest attempt at correctly pricing at the start, adjustments may have to be made to the list price to attract more interested buyers, as previously explained. You’ll see in the graphic below how to determine the level of reduction that needs to be made.

You can see that if you accurately price your home, you are in the bullseye and receiving strong offers. If not, the areas around the bullseye will tell you roughly how much of an adjustment is recommended.

Get Your Price on Target

-

- If your home is receiving showings but no offers, somewhere between a 3-5% adjustment should be made.

- If you’re receiving a small number of showings and only some drive ups, you probably need somewhere between a 6-11% adjustment.

- Not getting any showings at all is a red flag that at least a 12% adjustment is necessary. When this happens, sellers are usually the most hesitant to adjust because they just cannot believe no one has even come out to see the house.

There are factors and variables involved in a price adjustment that your experienced Realtor will be able to review with you.

Consider the Price Bracket

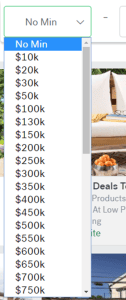

Along with comps and the Target Pricing Model, price brackets are a helpful tool to use when adjusting the price of your home. Simply put, lowering your price to the next bracket will expose your home to those people searching within that next price range.

Real estate websites set up their property search tools with price brackets. The person searching for a home will select the area, the number of beds, baths and as well, their price range. If your home is currently listed at $475,000, everyone searching for homes in the $450K to $500K range will see it, but you’re missing every person searching for homes under $450K.

The limitation with only following the Target Pricing Model is that if you are on the market at $429,000, and you adjust your price by say 5%, you will end up at an adjusted price of $407,550. If that is what the target pricing model calls for then you can do it but, in this case, it would be a lot smarter to shift down to $400,000 so that you can reach new buyers. Your home will fall into two brackets, the $350K to $400K as well as the $400K to $450K, if they’re in $50K increments. Although you’re listing for $7,550 less, you may receive multiple offers which could develop a bidding war. Bidding wars generally get homes sold for over asking, so you could theoretically make that money up in the end.

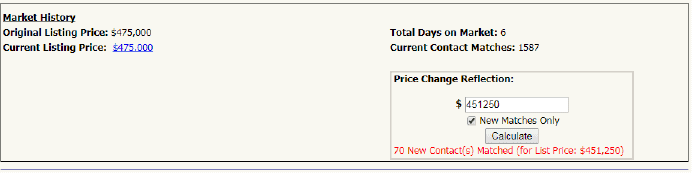

To illustrate this scenario, we went into the Multiple Listing Service (MLS), where all homes on the market are listed. We utilized the “Marketing Overview” feature which tells you how many additional matches you will receive from lowering the price.

From the image below, if the current list price of $475,000 was reduced by 5%, the new price would be $451,250. In the red text, you’ll see that by this reduction, the sellers will attract 70 more people. Please also note that the home will remain in its current bracket of $450K to $500K.

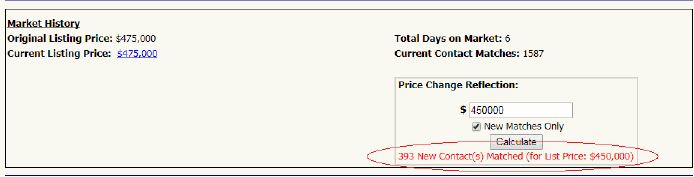

From this image below, however, you’ll see that if the current list price of $475K was reduced $1,250 more than that initial 5% reduction, the seller’s home would attract almost 400 buyers! For that small amount of money, 323 additional people will be reached than if the reduction was limited strictly to 5% which attracted just 70. Now, this home is in two price brackets, the $400K to $450K as well as the $450K to $500K.

When a listing in MLS has a price change, agents are notified as well as buyers with saved searches that match the home’s criteria. If the listing in this example changed its price to $450,000, 393 active buyers, as well as their agents, would be notified that this home is available to be purchased. This is an incredibly effective way to gain interest in a listing that has otherwise sat on the market without much of a response.

Final Thoughts

In the book Zillow Talk by Spencer Rascoff and Stan Humphries, Chapter 15 talks about pricing and more specifically, price adjustments. They say, “If you overprice, it’s better to admit your mistake and cut the price all the way down to the true market value in one fell swoop.”. They are absolutely right.

Sellers tend to see a lot of value in their home and lowering the list price can feel as if they are telling people that the home is less valuable. That is an emotional response to a business transaction, and although understandable, it’s not going to achieve the bottom line of selling the home for as much money as possible. If you are a seller, who has reached a point where buyers aren’t biting, lowering the price is the fastest way to attract more demand and more buyers.

When pricing your home, exploring comparative sold properties, the market climate in which those comps were sold, comparative active properties, the current inventory, and the current market, is a sure way to determine the best list price. This is just one of the many reasons why working with a trusted Lamacchia Realty REALTOR® is so crucial when selling, as they have the expertise and knowledge of the current market and how to determine a list price that will give you the most bang for your buck! By working closely with your REALTOR®, using the target pricing model, and paying attention to price bracketing, you will be equipped to handle price adjustments like a pro and get your home sold!